japan corporate tax rate history

Again this suggests a positive association between GDP growth and corporate tax rates. Comoros has the highest corporate tax rate globally of 50.

Real Estate Related Taxes And Fees In Japan

115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate.

. From 875 to 203 depending upon the location of the business establishment. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Next JPY 70 million per annum.

Corporate Tax Rate 3062. Personal Income Tax Rate 5597. Sales Tax Rate 1000.

Corporate Tax Rate. Corporate income taxsolidarity surcharge. This page provides - Japan Interest Rate - actual values historical data forecast chart statistics economic calendar and news.

The present corporate taxation level will vary from 15 up to 232 on the annual net business income of the company. Fifteen countries do not have a general corporate income tax. Local management is not required.

3-1-1 Kasumigaseki Chiyoda-ku Tokyo 100-8940 JAPAN Tel. Outline of the Reduced Tax Rate System for Consumption Tax. The Reduction of Statutory Corporate Tax Rates.

Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. The taxes may also be referred to as income tax or capital taxA countrys corporate tax may apply to. An update to this dataset has been posted to the Tax Foundation Github data archive.

Japan Corporate tax rate. Puerto Rico follows at 375 and Suriname at 36. Items Covered by the Reduced Tax Rate System Information on Japanese tax system can also be obtained from the following URL.

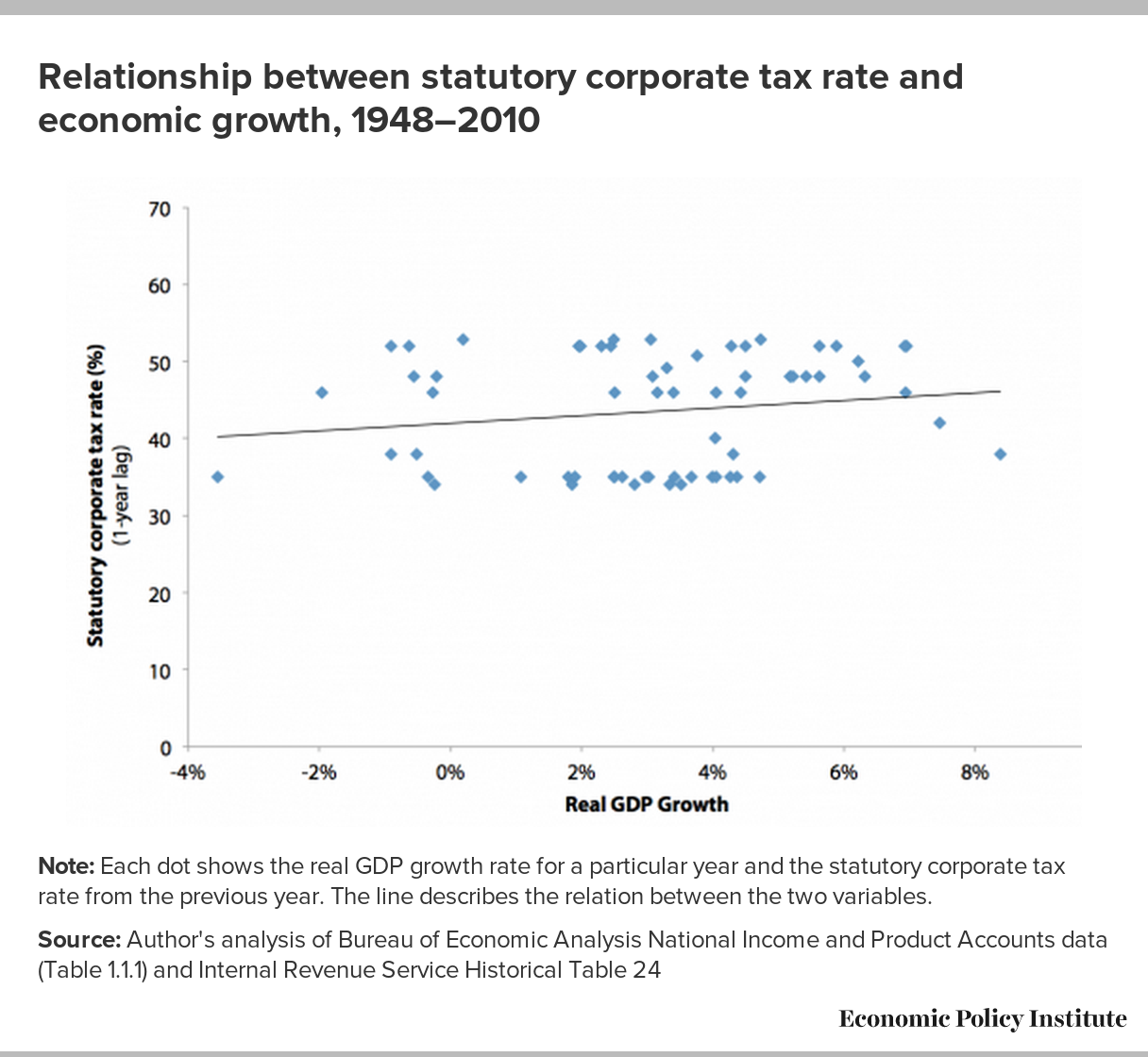

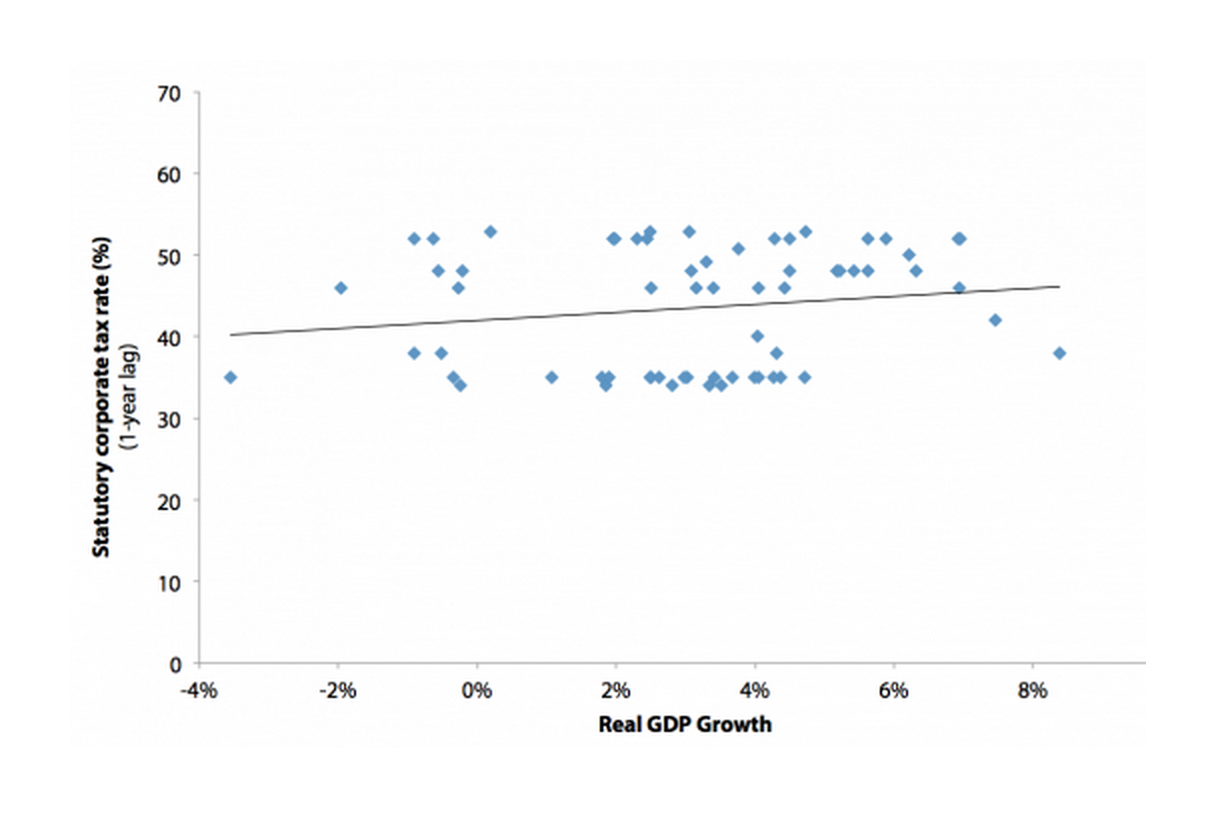

Interest Rate in Japan averaged 235 percent from 1972 until 2022 reaching an all time high of 9 percent in December of 1973 and a record low of -010 percent in January of 2016. Many countries impose such taxes at the national level and a similar tax may be imposed at state or local levels. The statutory corporate tax rate is also displayed in Figure B in dark blue.

For any domestic corporation registered in Japan both for domestic and subsidiaries of foreign companies a corporate tax on national level is levied by the National Tax Agency an integral part of the Ministry of Finance. Ghana Last reviewed 18 July 2022 25. There are consumption taxes and excise taxes at the national level an enterprise tax and a vehicle tax at the prefectural level and a property tax at the municipal level.

Excluding jurisdictions with corporate tax rates of 0 the countries with the lowest corporate tax rates are Barbados at 55 Uzbekistan at 75 and Turkmenistan at 8. Chapter 3 - Table 32 Total tax revenue in US dollars at market exchange rate Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue. OECD Corporate Income Tax Rates Australia Austria Belgium Canada Chile Czech Republic Denmark Estonia Finland France Germany Greece Hungary Iceland Ireland Israel Italy Japan Korea Luxembourg Mexico Netherlands New Zealand Norway Poland Portugal Slovak.

The tax rate leveled at about 52 to 53 percent through most of the 1950s and 1960s then fell in steps to 35 percent. Family corporation tax rate First JPY 30 million per annum. Over JPY 100 million per annum.

The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with. Taxes are administered by the National Tax Agency. A corporate tax also called corporation tax or company tax is a direct tax imposed on the income or capital of corporations or analogous legal entities.

Taxation in Japan is based primarily upon a national income tax 所得税 and a residential tax 住民税 based upon ones area of residence. For tax years beginning after 2017 the Tax Cuts and Jobs Act PL. Social Security Rate 3152.

Real Estate Related Taxes And Fees In Japan

Toward Meaningful Tax Reform In Japan Cato Institute

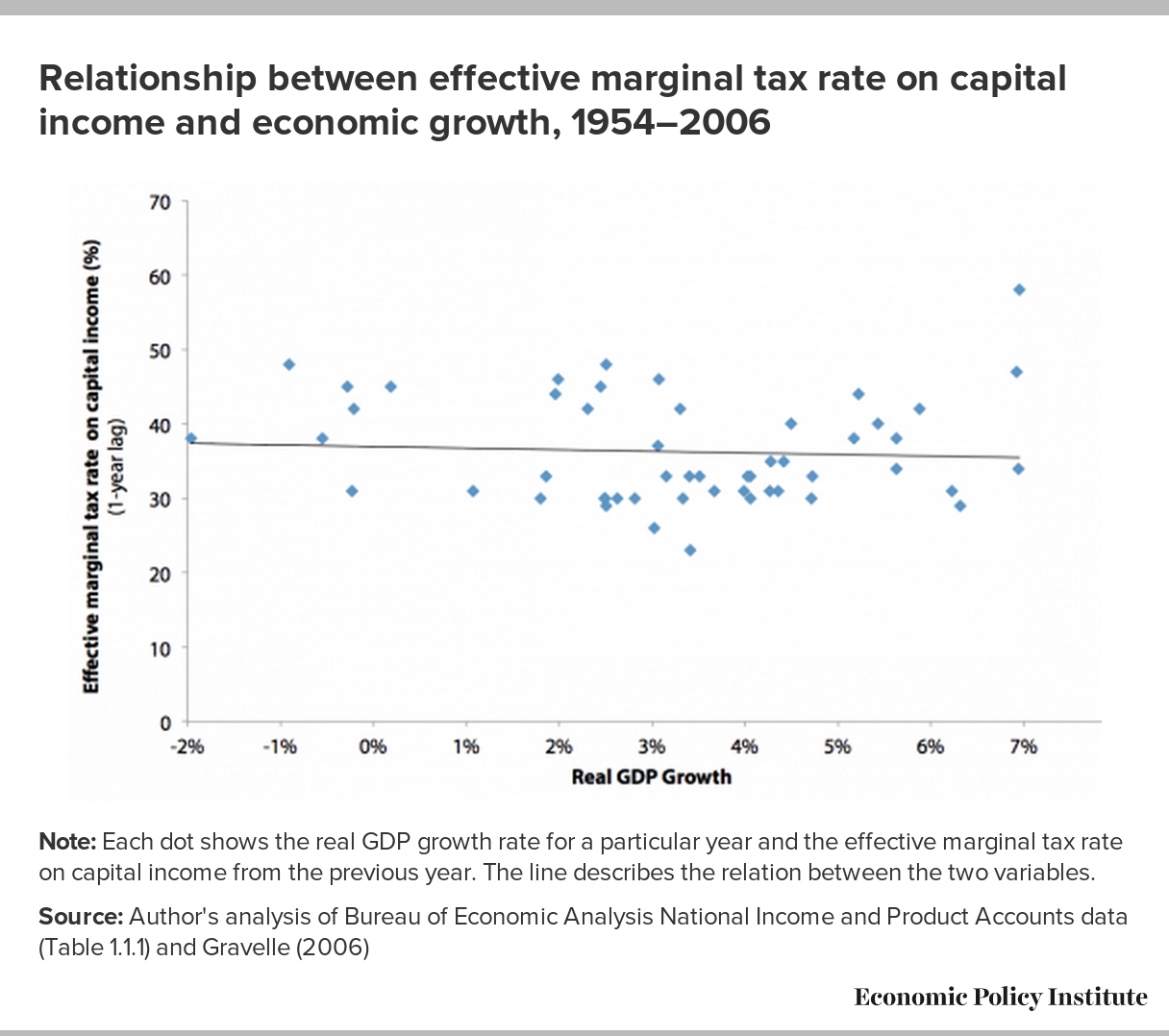

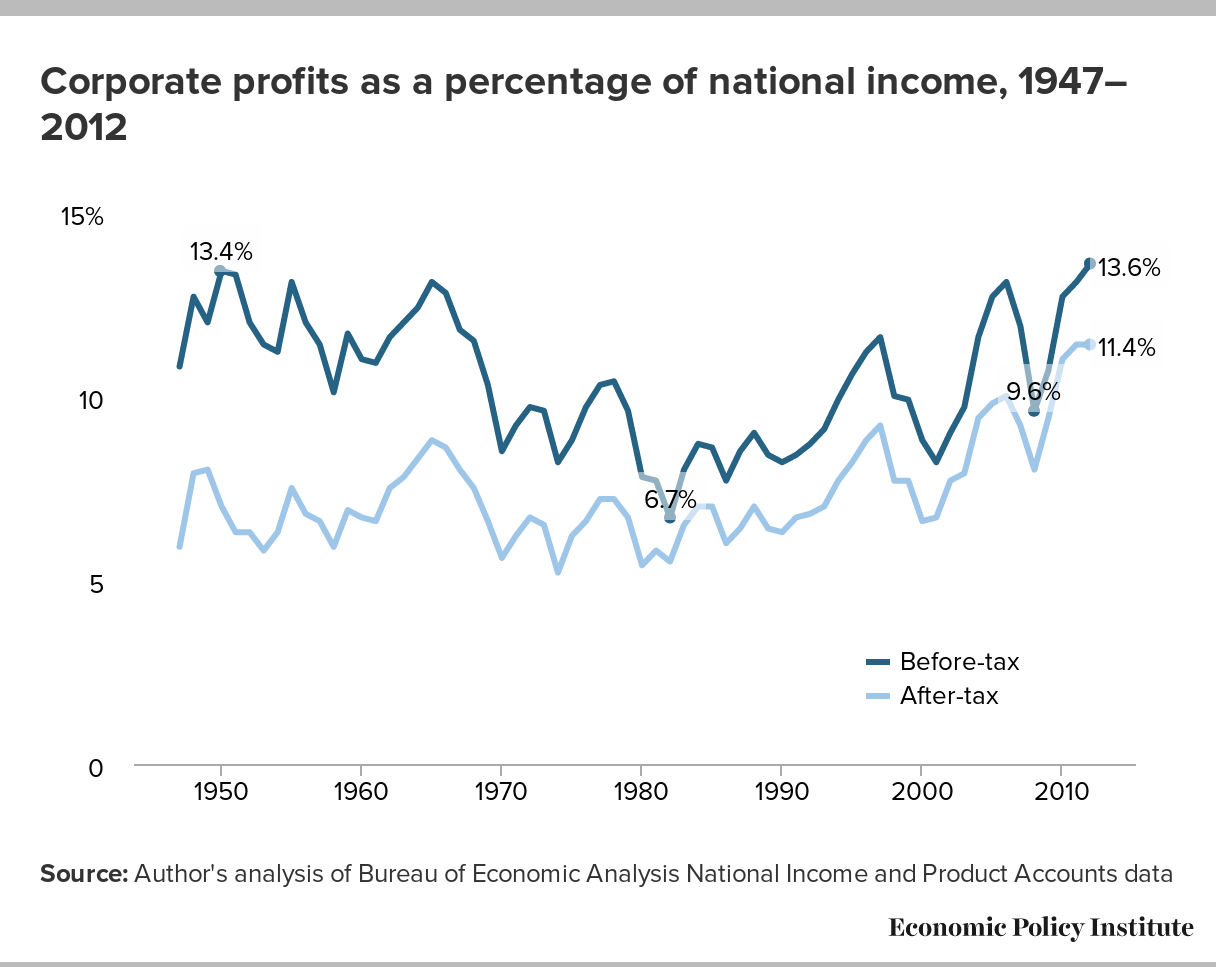

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Tax Reform In The Wake Of The Pandemic Itep

Real Estate Related Taxes And Fees In Japan

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Toward Meaningful Tax Reform In Japan Cato Institute

Real Estate Related Taxes And Fees In Japan

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Real Estate Related Taxes And Fees In Japan

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute